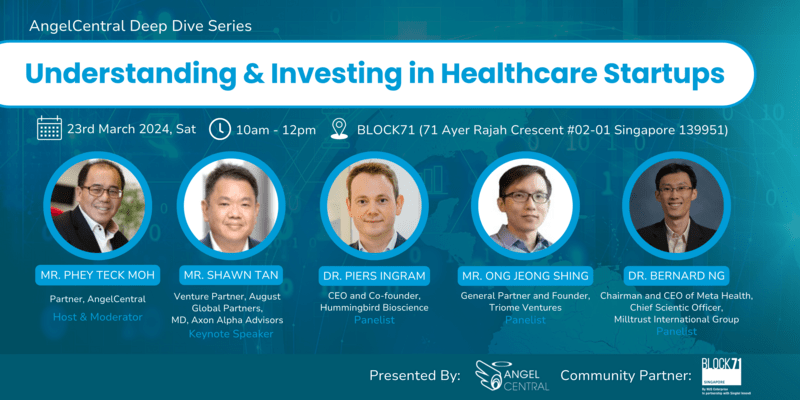

AngelCentral Deep Dive Series: Understanding and Investing in Healthcare Startups

Over the years, modern technology has helped healthcare to make impressive advancements in overall quality and efficacy. Singapore’s biomedical sector is an important pillar of the economy delivering ~5% of GDP (~US$19B). Over the last 2 years more than S$770M has been funded into 47 SG based biomedical companies by investors.

Every year an increasing number of biomedical startups are incepted and come to market with innovative platforms, medical devices, and new biopharma drugs. The list of funded biomedical startups in Singapore includes: MiRXES, Holmusk, Lucerne, LionTCR, AWAK Technologies, Hummingbird Biosciences, Doctor Anywhere, Homage, Docquity, Biofourmis, Immunoscape, Biolidics, and many others.

Given the many different stakeholders involved in developing, delivering, funding, and regulating healthcare, and the complexity of underlying medical afflictions, there is a wide range of unmet needs which are being met by an equally diverse number of companies and technologies.

Some of these opportunities may simply be to take proven solutions in advanced markets into untapped regional markets (e.g. telehealth). Whilst others relate to developing first-in-class or best-in-class technologies that can compete globally (e.g. new drugs or medical devices).

In this workshop, we will seek to articulate the opportunities and potential pitfalls of investing in the biomedical startup space uniquely through the lens of experienced Singapore based investors. Participants will be provided with a broad framework to help them understand, evaluate, and better appreciate the rewards and risks of investment opportunities that are often presented in our ecosystem.

Bring home a deeper understanding of the following:

- A general overview of the healthcare/biomedical market

- The evolution of Singapore’s biomedical startup landscape

- The different milestones, challenges, and resources needed to bring various biomedical innovations to market

- A framework to evaluate biomedical investments

Keynote Speaker: Mr. Shawn Tan, Venture Partner at August Global Partners, Managing Director at Axon Alpha Advisors

Shawn has over two decades of experience executing direct investments as well as managing portfolio asset allocations. He is currently the Managing Director of Axon Alpha Advisors, the Investment Manager for the ACT Family Office funds, where he oversees a portfolio of public and private market assets including venture capital and private equity investments. In addition, Shawn is also a Venture Partner with August Global Partners a healthcare focused investment firm spun-out from the Economic Development Board of Singapore’s investment division (EDBI).

He was previously a Venture Partner and Investment Principal with Novo Tellus Capital, a private equity firm specializing in control deals in the technology and industrial sectors. Prior to that Shawn was part of the senior Management Team at EDBI where he was in-charge of investments into Singapore enterprises.

Earlier in his career, Shawn was involved in the commercialisation and development of technology enterprises at the Agency for Science Technology and Research (A*STAR). Whilst at A*STAR, Shawn licensed the SARs PCR Diagnostic Kit from the Genome Institute to Roche.

Shawn holds a Bachelor with Honours Degree in Genetics and Molecular Biology from Glasgow University, UK and a Master’s Degree in Applied Finance from Adelaide University, Australia.

Some of the healthcare projects he has been involved in previously include:

- Biosensors Ltd (Medical Device - Drug Eluting Stent)

- Hummingbird Bioscience (Biopharma – mAb Drug Development)

- Inovio Pharmaceutical Inc (Biopharma/Device – DNA Vaccines & Electroporation)

- BotMD (Healthtech)

Panelist: Dr. Piers Ingram, CEO and Co-Founder at Hummingbird Bioscience

Piers Ingram is the Chief Executive Officer and co-founder of Hummingbird Bioscience. Excited by the increasing pace of progress in systems biology and immunology, Piers co-founded the company in 2015 to better apply these advances to drug discovery and development.

Prior to co-founding Hummingbird Bioscience, Piers spent 15 years in the biopharmaceutical industry in R&D consulting, commercial strategy and academia. Between 2013 and 2015, Piers was employed by Sanofi (NASDAQ: SNY) as Head of Strategic Planning, South East Asia, and between 2011 and 2013 at Monitor Group (and then Monitor Deloitte) as a Manager in the Strategy Consulting practice. Between 2008 and 2010, Piers was first a Research Fellow and then acting Research Group Head at the Centre for Integrative Systems Biology, Imperial College London. Piers holds an MSci in Mathematics, an MSc in Bioinformatics and a PhD in Systems Biology from Imperial College London, and an MBA from INSEAD.

Panelist: Ong Jeong Shing, General Partner and Founder at Triome Ventures

Jeong Shing (JS) has over 15 years of global healthcare experience across corporate pharma, technology management and venture capital, including incubating and building early stage life science companies. He was Partner at EDBI, the strategic venture arm of the Economic Development Board of Singapore, leading healthcare investments in biotech, medtech, digital health and life science tools, as well as Fund of Fund investments. His investment track record and network span key geographies including USA, China, Singapore and Southeast Asia, which is complemented by his operational experience in helping portfolio companies pursue international expansion.

Prior to EDBI, JS oversaw investments at Venturecraft, a Singapore based boutique venture capital firm and multi-family office focusing on tech and healthcare. He successfully set up a digital health incubator supported by the Singapore government and nurtured several successful start up companies such as US2.AI, Hearti Labs and Aktivo. He also established a life science accelerator in Hangzhou China, to help portfolio companies accelerate product and clinical development and gain rapid access to the Chinese market. Before starting his venture career, JS led process development and scale up at Glaxosmithkline, working across UK, US and Singapore and on multiple assets in oncology and respiratory diseases.

His select healthcare investments include Kaleido Biosciences (NASDAQ: KLDO), Mirxes, Doctor Anywhere, Aetion, Neuroglee, Engine Biosciences and Immunoscape.

JS earned First Class Honours Degrees in Bioengineering and Chemical Engineering from the National University of Singapore, and holds an MBA with distinction from the University of Cambridge, specializing in Private Equity.

Panelist: Dr. Bernard Ng, Chairman and CEO of Meta Health, Chief Scientic Officer, Milltrust International Group

Dr Bernard Ng is the Chief Executive Officer and the chair of the Board for Meta Health Ltd, a listed company on the Singapore exchange who has recently diversified into healthcare technology and services.

Dr Ng obtained his Doctor of Medicine from the National University of Malaysia and practiced clinical medicine in Malaysia before joining the pharmaceutical industry, focusing on medical affairs, patient safety, research and development. He obtained his MBA from the University of Melbourne and is a strong believer of the Disruptive Strategy model by the Clayton Christensen from Harvard Business School. He also was in IMD, Lausanne for a digital transformation course to better understand the disruptive power of platforms in today’s competitive environment.

Dr Ng is an angel investor and a successful professional in the field of medical and clinical affairs globally. He has had leadership roles with global and regional experience in the healthcare industry, leading teams in US, Europe and Asia. Previously the Chief Medical Officer, Head of Medical Strategy and Clinical Development for Bayer Consumer Healthcare and he is an active proponent of leveraging digital technologies and data to create disproportionate value for healthcare professionals, patients and consumers with experience in leading digital transformation initiatives and due diligence for M&A.

Dr Ng was on the Investment Advisory Committee for the British Innovation Fund (BIF), partnering with the leading Universities and Centres of Innovation in the UK to build a successful portfolio of early-stage companies. Notable successes include Vaccitech, the University of Oxford AZ vaccine company which listed on NASDAQ in 2021.

Dr Ng is also a visiting lecture with the Dept of Cancer & Pharmaceutical Sciences, Faculty of Life Sciences & Medicine at King’s College London. He also sits on the advisory boards of promising Singapore startups like Oncoshot and Safespace. He is a strong believer in paying it forward where he spends time mentoring the future leaders of the industry and STEM graduates in Singapore.

Host and Moderator: Phey Teck Moh, Partner, AngelCentral

Phey Teck Moh is a mentor and angel investor in the Singapore entrepreneur ecosystem. He is a cofounder and partner at AngelCentral. At Xpanasia, it is an advisory company specializing in Telecommunications and Information Technology companies in Asia Pacific. He retired as Asia President, Motorola Solutions. During his tenure, Motorola Solutions Asia Pacific grew the revenue to more than US$1B. Prior to Motorola, Phey was the President & Chief Executive Officer of Pacific Internet, a NASDAQ- listed Internet service provider in Asia Pacific. He is active in YPO Singapore, on the executive committee for 6 years.

About AngelCentral

AngelCentral is the most active community of angel investors in Southeast Asia. We organize regular curated pitch sessions, angel education workshops, and provide syndication services. The idea for AngelCentral started in late 2016 as a community initiative by the Partners to share their personal experiences and lessons learned on angel investing. With the initial success and validation of their efforts in 2017, AngelCentral incorporated officially in February 2018 with the mission to build a community of effective angel investors in Southeast Asia. Since Inception, AngelCentral has trained >1000 angels and our members have invested >S$30m into startups.

The event has passed. Find more upcoming event here or subscribe to our mailing list to receive the updates about the future events.

If you are an investor and would like to find out more about Angel Investing and what AngelCentral does, we have a coffee session hosted by the AngelCentral team. These informal chat sessions are held twice monthly where we will share about what we do, our membership offers, and/or what Angel Investing is all about. Secure your slots here.

If you are a startup and would like to raise funds from our members, send in your application here!